The Invisible War: How AI is Reshaping Bot Management & Fraud Prevention

From Automated Attacks to Adaptive Defenses—Why Businesses Must Evolve or Be Left Behind

Imagine waking up to discover that half of your website traffic isn’t from real customers—but from bots. Not the helpful kind, but malicious ones designed to steal data, hijack accounts, and exploit vulnerabilities. This isn’t a hypothetical scenario; it’s today’s digital reality. Automated threats and online fraud are evolving faster than ever, creating an arms race where businesses must continuously adapt or risk being left behind.

In this article, we’ll explore why bot management and fraud prevention have become mission-critical, the latest trends in automated attacks, and how AI-driven defenses are reshaping security strategies. We’ll break down key industry insights, market growth projections, and the leading players in the fight against bots and fraud. By the end, you’ll have a clear understanding of the emerging threats businesses face and the future of fraud prevention in an increasingly automated world.

So, if you’re wondering whether your security strategy is keeping pace with the ever-evolving threats, read on—because in this battle, staying still is the same as falling behind.

Market Size and Growth Projections

The market for bot management and fraud prevention solutions is growing rapidly. Estimates vary, but all point to strong double-digit growth. For instance, Grand View Research valued the global bot management solution market at roughly $723M in recent years, projecting it to reach about $4.87 billion by 2030 – a compound annual growth rate (CAGR) of around 20.2% (2024–2030).

Similarly, the broader fraud detection and prevention market (which includes anti-fraud software and services across industries) is tens of billions in size and expanding fast. Grand View Research estimates $33.1 billion in 2024 for the global fraud prevention market, with ~18.7% CAGR through 2030.

Trends in Bot Attacks and Fraud Attempts

Automated attacks by bots are rising in frequency and sophistication, driving industry trends. According to Imperva’s 2023 Bad Bot Report, nearly half of all internet traffic in 2022 (47.4%) came from bots – up ~5 percentage points from the prior year. In particular, **“bad” malicious bots made up 30.2% of all web traffic (up from ~27% in 2021). This indicates that automated fraud attempts and bot-driven abuse are a growing threat. Over the past four years, bad bot traffic has steadily climbed.

Notably, bots are becoming more evasive. In 2022, advanced or “evasive” bots accounted for about 66.6% of bad bot traffic (combining moderate and advanced bots). These sophisticated bots can mimic human behavior (e.g. fake mouse movements, defeat CAPTCHAs) and cycle through IPs to avoid detection. Meanwhile, simpler bots have stagnated at ~33% of bad bot traffic. This shift means security teams face increasingly stealthy automated attacks. Common attack types include credential stuffing (for account takeover), web scraping, carding, fake account creation, and other business logic abuses. Imperva observed a 155% jump in account takeover (ATO) attacks from 2021 to 2022, correlating with major data breaches (attackers used leaked credentials to hijack accounts). In one case, bots scraping an airline’s API racked up $500k/month in charges, and in another, millions of bot login attempts led to widespread account lockouts at a bank. API endpoints are a prime target – 17% of attacks on APIs in 2022 were malicious bots abusing logic, with another 21% being other automated threats.

On the fraud side, online payment fraud and scams continue to rise. In 2023, the U.S. FTC reported a record-high $10.2 billion in losses from fraud scams. Businesses likewise report growing fraud losses, which is driving the adoption of fraud prevention tools. There is also a trend of “cyber-fraud fusion”: cybersecurity attacks and fraud schemes are converging. Gartner notes that nearly 70% of security leaders now view account takeover as a top concern, blurring the line between InfoSec and fraud prevention teams. In fact, Gartner predicts that by 2028, 20% of large enterprises will have merged their cybersecurity and fraud departments into unified teams (up from <5% today) to better fight automated threats.

Imperva data shows bad bot traffic climbing from ~30% to 32% of internet traffic from 2022 to 2023

Account takeover attacks grew 155% in one year from 2021 to 2022 and then another 10% from 2022 to 2023 as per Imperva’s Bad Bot Report 2023, 2024

Geographic Distribution of Attacks

Bot attacks and online fraud are global, but certain regions see higher activity. Imperva’s research indicates the United States is by far the top target of bad bot traffic. In 2022, roughly 43% of bad bot attacks targeted U.S.-based websites, and this grew to 47% in 2023. The large online market and many high-value targets in the U.S. make it a frequent focus for bot operators.

After the U.S., other countries see a significant (though much smaller) share. Australia was unusually targeted in 2022 (16.4% of bad bot attacks), though it dropped to ~8.4% in 2023. The Netherlands emerged as the second most targeted in 2023 with about 9% of global bot attacks, overtaking Australia that year. The UK is consistently in the top tier (~6–7% of attacks), and France appears in the top five (around 3–5%). These variations may reflect where online businesses are located and where attackers find lucrative opportunities.

In terms of attack origin, bots often route through global infrastructure to mask their true location. A growing tactic is the use of residential proxies – in 2023 about 26% of bad bot traffic came via residential IP proxies (making malicious traffic appear to be coming from ordinary user networks). Additionally, nearly 45% of bad bots pretended to be mobile browsers (e.g. Android or iPhone user agents) to appear legitimate. This means the geographic source of bot traffic is highly distributed and often “laundered” through innocent-looking nodes, even while the targets are concentrated in certain countries.

Leading Companies in Bot Mitigation and Fraud Prevention

The industry landscape is led by a mix of specialized bot mitigation providers and broad fraud prevention platforms. In the bot management segment, notable leaders include:

Cloudflare – offers an integrated bot management solution as part of its security platform. Gartner recognized Cloudflare as a Leader in WAAP security

Akamai – provides the Akamai Bot Manager and boasts a large CDN footprint for threat intel. Akamai is a longtime major player in web security.

Imperva – offers Advanced Bot Protection (formerly Distil Networks) and attack analytics. Imperva is frequently cited in analyst reports

F5, Inc. (Shape Security) – F5’s Distributed Cloud Bot Defense (from its Shape acquisition) is known for its high efficacy against sophisticated bots.

HUMAN Security – formed from the merger of White Ops and PerimeterX, HUMAN focuses on bot fraud across ad tech and application security. It was named a Leader in The Forrester Wave™: Bot Management 2024

DataDome – a newer vendor providing AI-driven bot detection as a service (recognized as a Strong Performer in recent evaluations).

Kasada – an anti-bot specialist known for its innovative tactics (also noted as a Strong Performer)

Radware – offers a bot management solution integrated with its application protection suite.

On the fraud prevention side (transaction and identity fraud focus), leading vendors include:

Arkose Labs focuses on bot attacks and abuse prevention, using a challenge-response approach often used to mitigate credential stuffing and fake account creation.

ThreatMetrix – provides device fingerprinting and a global identity network for fraud detection.

Feedzai – recognized in the 2024 IDC MarketScape as a Leader in enterprise fraud management for financial institutions. Feedzai uses real-time machine learning on transactions to flag fraud.

TransUnion (via Iovation/Kount) – Kount (now part of TransUnion) is widely used for e-commerce fraud prevention.

FICO – offers the Falcon platform, a longtime leader in card fraud analytics and expanding with AI decisioning tools

SAS – provides fraud detection solutions with advanced analytics and is identified as a Leader in various analyst rankings

Forter – a specialist in retail e-commerce fraud prevention, noted for instant transactional risk scoring.

Emerging Threats That Demand Attention

Credential Stuffing: The Gateway to Account Takeovers

Stolen credentials from past breaches fuel a relentless wave of automated login attempts. In fact, credential stuffing attacks have surged by 155% year-over-year, with some businesses reporting that nearly half of all login attempts on their platforms are malicious. Traditional password-based authentication isn’t enough—organizations need layered defenses, including bot mitigation, multi-factor authentication, and behavioral analysis.

Synthetic Identities: Fraudsters’ Favorite Disguise

Fraudsters are no longer just stealing identities—they’re manufacturing them. By blending real and fake data, they create synthetic identities that are difficult to detect, leading to billions in financial fraud losses. Deloitte projects this type of fraud will reach $23 billion by 2030. AI-driven identity verification is becoming essential in distinguishing real users from fabricated ones.

AI-Driven Fraud Prevention Advancements

Artificial intelligence and machine learning are at the core of modern fraud prevention and bot management. In recent years, virtually all leading solutions have incorporated machine learning models to detect anomalous behavior. For example, Forrester noted that top bot management vendors employ teams of data scientists and multiple ML models, moving beyond simple rule-based detection. These AI models analyze hundreds of signals (behavioral patterns, device data, network indicators) in real time to distinguish legitimate users from bots or fraudsters. HUMAN Security’s platform, for instance, evaluates 2,500+ signals per interaction with 400+ adaptive ML models to make high-speed decisions on traffic.

Adoption of AI in fraud programs is accelerating, but there’s a gap between interest and implementation. According to a global survey by the ACFE and SAS, as of late 2023, only about 18% of anti-fraud professionals were actively using AI/ML tools, but an additional 32% plan to within two years. This suggests usage could roughly triple to ~50% of organizations by 2025. Indeed, 83% of fraud fighters expect to deploy generative AI by 2025 in some capacity. The enthusiasm is high, though actual deployment has lagged behind earlier expectations AI adoption in fraud has grown only ~5% since 2019, indicating challenges in operationalizing these technologies).

Nevertheless, AI-driven advancements are showing tangible benefits. Machine learning-based fraud systems can analyze far more data points (e.g. user behavior biometrics, device telemetry, historical transactions) than manual methods, often boosting fraud detection rates while reducing false positives. Vendors highlight capabilities like behavioral biometrics (analyzing how a user types, swipes, etc.) to catch imposters, and anomaly detection on streaming data for real-time fraud interdiction. For example, Feedzai’s risk engine continuously learns evolving fraud patterns and adapts its models to new attack tactics. Such AI adaptiveness is crucial as fraudsters also change techniques quickly.

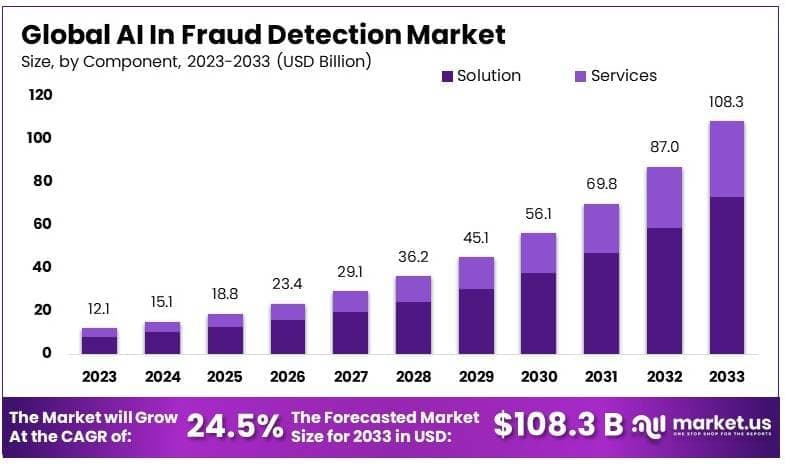

Generative AI is a double-edged sword: it offers new defense tools (e.g. creating synthetic data to train models, automating investigation tasks), but also empowers attackers (e.g. deepfakes to bypass verification or AI-written scripts to mimic humans). This has led to an “arms race” where both sides leverage AI. Organizations are investing more in AI-powered defenses – in fact, the “AI in fraud detection” market is projected to soar to ~$108 billion by 2033 (24.5% CAGR) as banks, merchants, and security firms pour resources into AI tech.

As per Market.us, there will be exponential market growth of AI in fraud detection (e.g., a projected leap from ~$12B in 2023 to $108B in 2033)

Looking Ahead: The Next Five Years

AI-driven fraud detection will dominate, with 83% of organizations planning AI adoption by 2025.

Regulatory pressure will intensify, pushing businesses to adopt integrated fraud and cybersecurity solutions.

Frictionless security will replace CAPTCHAs, as companies focus on seamless user experiences.

The bot management market will continue its rapid expansion, reaching $4.87 billion by 2030.

Final Thought: Adapt or Be Left Behind

The battle against fraud and bot-driven attacks is far from over. As attackers grow more sophisticated, businesses must think beyond traditional security measures and adopt a holistic, intelligence-driven approach. Investing in AI-powered solutions, integrating bot management with fraud prevention, and staying ahead of regulatory changes will define the winners in this space. Ultimately, cybersecurity is no longer just an IT problem—it’s a business imperative that requires strategic execution, relentless adaptation, and a forward-thinking mindset.

References

Imperva - 2023 Bad Bot Report ; 2024 Bad Bot Report

IDC Marketscape - O’Malley Sean, Worldwide Enterprise Fraud Solutions 2024 Vendor Assessment

Embracing the Future of Online Fraud Detection: Gartner® Recommendations for Cyber-Fraud Fusion

Gartner®: Market Guide for Online Fraud Detection

Gartner Magic Quadrant for Web Application and API Protection 2022

Forrester Analytics: Fraud Management Solutions Forecast 2017–2023